- Rimac Group

- Company

Rimac Group Raises Eur 500 Million in Series D Investment Round Led by Softbank Vision Fund 2 and Goldman Sachs Asset Management, Investing Alongside Existing Shareholders

Proceeds will support the company’s continued innovation in manufacturing, production expansion and ongoing talent acquisition.

Proceeds will support the company’s continued innovation in manufacturing, production expansion and ongoing talent acquisition.

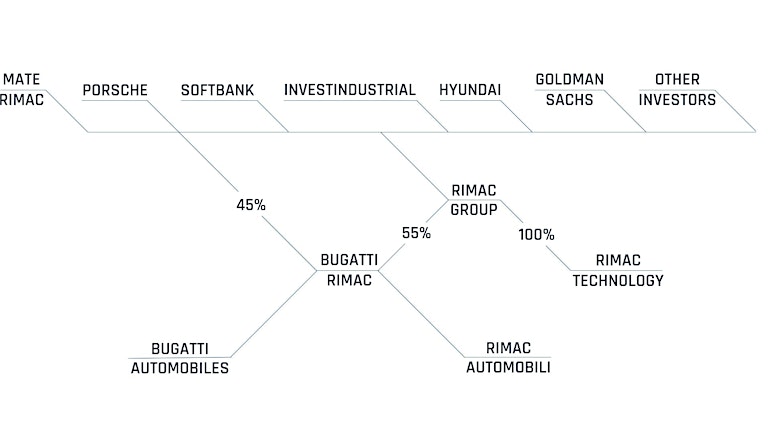

1 June, 2022, Zagreb – Rimac Group (“Rimac” or the “Company”), a leader in electrified vehicle technology, raised EUR 500 million in its Series D, valuing the Company at over EUR 2bn. The fundraising was led by SoftBank Vision Fund 2 and the Private Equity business within Goldman Sachs Asset Management, with participation from existing Rimac shareholders, including Porsche and InvestIndustrial. Mate Rimac remains the largest shareholder of the Company.

Rimac, through its subsidiary Rimac Technology, has fast become a Tier 1 technology partner to global automotive Original Equipment Manufacturers (OEMs) through designing, engineering and manufacturing high-performance electrified vehicle components such as batteries and e-axles.

In November 2021, Rimac also successfully completed the merger of Rimac’s hypercar division – Rimac Automobili – with Bugatti Automobiles. Both brands now operate under the Bugatti Rimac company, a world leading ultra-luxury and high-performance hypercar manufacturer.

This latest Series D investment reflects Rimac’s success both in developing and delivering high-performance electrified vehicle components and in-house-developed hypercars. The funds will be primarily used to further develop Rimac Technology as it commences large-volume series production for global OEMs.

Using the expertise gained from developing the all-electric Rimac Nevera hypercar from the ground up, Rimac has developed a range of products that take customers through the entire product creation process – from concept to large-scale production. Rimac Technology has already undertaken partnerships with leading global brands including Porsche, Hyundai, Automobili Pininfarina, Koenigsegg and Aston Martin.

Rimac Technology is ramping up its production capacity and completing work on the new Rimac Campus. Running at full capacity from the Rimac Campus, Rimac Technology will be capable of producing tens of thousands of components each year, with products ranging from hybrid and fully electric battery systems to full rolling chassis.

The Rimac Campus will also become the HQ of Bugatti Rimac which is responsible for the future development of both the Bugatti Automobiles and Rimac Automobili hypercar brands and will furthermore become the production site for Rimac Automobili’s Nevera hypercar – the world’s fastest accelerating production car with every major component designed and engineered by the Rimac team.

Mate Rimac, CEO of Rimac, said: “Rimac has ambitious growth plans in the next few years, and we are humbled by the support of significant new investors like SoftBank Vision Fund 2 and Goldman Sachs Asset Management believing in our vision. Our gratitude also goes to Porsche and InvestIndustrial who have played an important part in our success so far and reinforced their support with new investment. As we look to rapidly scale the Group, establish new manufacturing processes to meet global automotive demand, recruit 700 talented team members in 2022, open new offices in several locations across Europe and expand our new production facilities at the Campus and beyond, the backing of our expert investors will be an invaluable guide through this uncharted territory. I would also like to personally thank all of our employees as without their hard work, loyalty and enthusiasm for the Rimac vision, we wouldn’t be here today.”

Jimi Macdonald, the investor for SoftBank Investment Advisers, said: “We’re witnessing a rapid demand for electrification in an industry facing significant challenges adapting to this technological shift. Rimac has quickly established itself as a leading EV technology partner to global OEMs supporting their transition to an electric future. We are pleased to support Mate and his team in building on this success and taking Rimac to the next level.”

Michael Bruun, EMEA Head of Private Equity within Goldman Sachs Asset Management, said: “We look forward to partnering with Mate Rimac and management in their innovation agenda and growth journey to push the limits of battery and electric powertrain performance.”

Lutz Meschke, Deputy Chairman of the Executive Board of Porsche AG and Member of the Executive Board for Finance and IT, said: “We were already convinced of the company’s potential in 2018 and are pleased that we were able to contribute to its progress and current success with our commitment. With new investors on board, Rimac is further expanding its position in electromobility and thus becoming an even stronger partner for Porsche. The close cooperation creates added value on both sides in terms of technology and innovative strength”.

Andrea C. Bonomi, Chairman of InvestIndustrial’s Industrial Advisory Board, said: “We are delighted to continue to support the company in its industrial expansion plan, which will make Rimac the driving force in the transition towards electromobility solutions. We welcome the new shareholders that strengthen the group further.”

About Rimac Group

The Rimac Group, led by CEO Antony Sheriff and President Mate Rimac, owns 100% of Rimac Technology, is majority shareholder of Bugatti Rimac and is invested in Verne. The Rimac Group manages the ecosystem of Rimac companies that provide premium & luxury technology solutions in the mobility and energy sector. The headquarters is based on the outskirts of Zagreb, Croatia, with locations around Europe. Mate Rimac remains single largest shareholder of the Rimac Group, with other investors including Softbank, Goldman Sachs Asset Management, Porsche, Hyundai Motor Group and more.